Community & Giving

We are passionate about giving back and making a positive impact on the communities in which we live and work. Below is a list of local and national organizations we’ve had the privilege of getting involved with, whether through our time, resources or other forms of engagement.

Montreal General Hospital Foundation

Major donor to the Clinical Innovation Platform (CLIP).

Calgary Surge

Official Wealth Management Partner of the Calgary Surge, a professional basketball team based in Calgary, Alberta.

Gordon Hoffman Charity Golf Tournament

Sponsor of the Gordon Hoffman Charity Golf Tournament. Proceeds of the tournament help children and their families affected by Learning Disabilities and ADHD in Calgary, ensuring they are able to access the programs and services needed for success.

Shaw Charity Classic Golf Tournament

Sponsor of the Shaw Charity Classic. The SCC is a professional annual golf tournament in Calgary that benefit charities, children, and families in Alberta and has raised more than $93 million for over 270 children and youth charities across the province.

Sun Youth Organization

Every year, we host an annual holiday drive to collect food and new toys for children and families in need in Montreal.

Concordia University

In-course scholarship established by RWM in 2023. This scholarship is intended to encourage and reward full-time JMSB students who identify as members of an underrepresented group.

University of Calgary

The Rothenberg Wealth Management Award was established in 2023 to help remove the financial barriers for deserving students of color to pursue their education at the Haskayne School and focus on their studies.

Bell Let’s Talk day

Brain Canada Foundation

Tribute To Dr. Mulder (2023)

Calgary Interclub Squash Association (CISA)

Proud Title Sponsor of the 2023/2024 Men’s Level 1 Final.

Rothenberg Gives Back

The new capital gains tax policy, effective from June 25, 2024, brings significant changes for individual investors, corporations, and trusts. This new policy imposes a higher tax rate on earnings from the sale of assets, like stocks or investment properties, also known as capital gains.

Capital Gains Inclusion Rate Changes

- Individual Investors: Previously, individual capital gains exceeding $250,000 were taxed at a rate of 50%. However, under the new policy, these gains will now be subject to a higher tax rate of 66.67%. It’s important to note that this increased rate only applies to gains earned after the initial $250,000. The first $250,000 of gains within a tax year will still be taxed at the original rate of 50%.

- Corporations and trusts: Corporations and trusts, unlike individual investors, will not benefit from the lower rate on the first $250,000 of annual capital gains. Instead, they will be subject to the higher tax rate of 66.67% right from the first dollar of gains.

The increase in the capital gains tax inclusion rate will have various implications depending on your situation. For example, the new policy may affect the timing of your investment sales, as well as the types of assets you choose to invest in. It’s important for you to understand how these changes will impact your overall tax liability and to plan accordingly.

Contact Us

If you have concerns about the new policy’s impact on your investments, we are here to help. Our team at Rothenberg Wealth Management provides free, professional advice and guidance. Our advisors can help you navigate the intricacies of the new capital gains tax landscape, understand the specifics of the policy, assess your current investment portfolio, and develop a plan to minimize your tax liability.

Old Age Security (OAS) is a source of income for many Canadians during retirement, but many retirees are concerned about losing a portion of their OAS benefits due to clawback rules that reduce these benefits after a certain income threshold. In this article, we’ll share some strategies to prevent your OAS benefits from being clawed back, allowing you to maximize your retirement income.

Old Age Security Clawback Calculator: How Much Can I Expect to Receive?

Before we begin, let’s review what the Old Age Security benefit is. If you are already familiar with OAS, you can skip this part and jump straight into the different strategies to reduce the impact of the OAS clawback. These strategies include:

- Income Splitting

- Utilizing Tax-Advantaged Savings Accounts: TFSAs and RRSPs

- Deferring OAS payments

- And other financial planning strategies

What is Old Age Security (OAS)?

Old Age Security is a pension benefit that provides a monthly payment to most Canadian retirees and seniors. If you meet the legal status and resident requirements for receiving OAS, you can start enjoying OAS benefits as soon as age 65 with the option to defer payments until the age of 70.

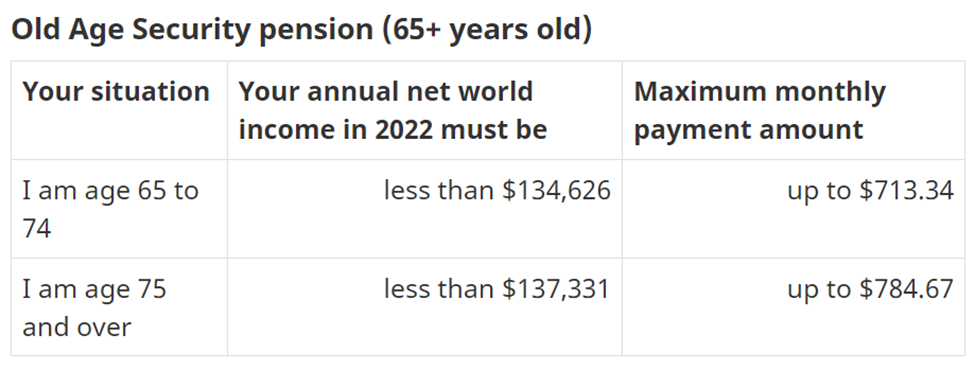

How much you will receive in OAS will depend on your income. As of April to June 2024, the maximum OAS monthly payment amount for individuals aged 65 to 74 is $713.34, and for those aged 75 and over, this amount is $784.67. These amounts are adjusted on a yearly basis depending on inflation.

It’s important to note that there is a maximum annual net income threshold for OAS eligibility. If your income exceeds this threshold, you will not be eligible to receive any OAS benefits. This is particularly relevant for high-income earners.

You can find all the details about maximum payments and income thresholds (April to June 2024) on the CRA website here in addition to other relevant information about Old Age Security.

Remember, OAS is a valuable pension benefit that supports Canadian retirees and seniors. Ensure you meet the requirements and understand the income thresholds to make the most of this benefit.

Now let’s discuss the different types of strategies to manage potential OAS clawback. Most strategies presented below focus on reducing your annual net income below the clawback threshold, since this is what the amount of OAS you receive will depend on.

Income Splitting

To manage your retirement income efficiently, consider income splitting with your spouse or common-law partner. This method involves sharing up to 50% of eligible income, such as from Registered Retirement Income Funds (RRIFs) or pensions, which can keep individual incomes below the clawback threshold. It’s a strategic way to reduce your overall tax burden and effectively manage your retirement income, ensuring you receive the maximum amount of OAS you’re eligible for.

Utilizing Tax-Advantaged Savings Accounts: TFSAs and RRSPs

Early strategic withdrawals from Registered Retirement Savings Plans (RRSPs) to fund your Tax-Free Savings Account (TFSA) can be a smart move, especially if you can do so before reaching higher OAS clawback thresholds.

Another option is contributing to an RRSP if you have the available contribution room. However, it is important to note that if you are already retired and getting OAS, contributing to an RRSP may not be an option if you don’t have the contribution room or are over the age of 71. As a reminder, the last day you can contribute to your RRSP is December 31 of the year you turn 71 years old.

Another strategy involves transferring your least tax-efficient investments, like Guaranteed Investment Certificates (GICS) and bonds, into a TFSA to reduce your taxable income and minimize future tax implications. In this way, you lower your income threshold and can qualify for a maximum in OAS benefits.

Deferring OAS Payments

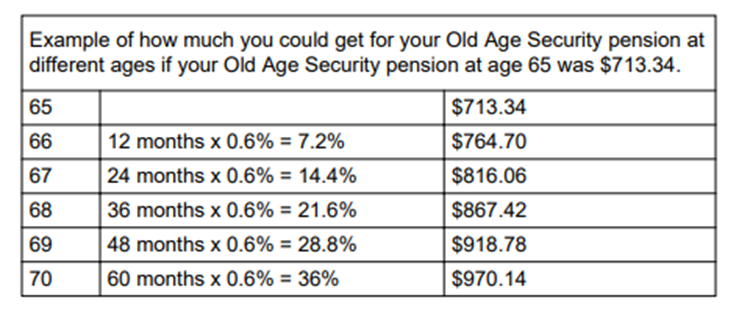

Another effective strategy you may benefit from is to delay receiving your Old Age Security (OAS) payments if you’re working past the age of 65. You have the option to defer your OAS up to the age of 70.

For each month you delay the start of your OAS pension up until age 70, your future monthly payments may increase by 0.6%. You can delay payment of OAS for up to 60 months, or 5 years, which means your OAS payments will go up by 7.2% per year up to a total maximum of 36%.

Old Age Security Clawback Calculator: How Much Can I Expect to Receive?

Example of Impact of Delaying OAS

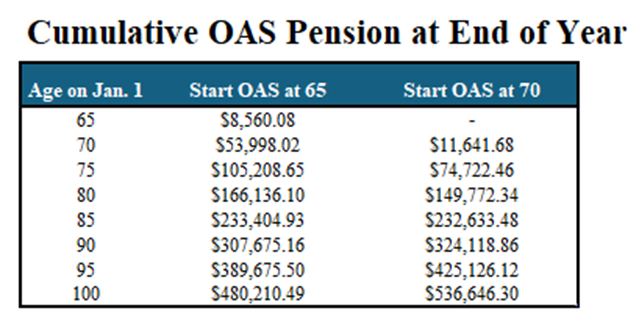

Delaying your OAS payments boosts your eventual payments and results in larger payments in the future but also provides a window to manage other retirement funds under lower tax brackets if you don’t need the OAS retirement income right away. You could also delay the first payment indefinitely, but there wouldn’t be any advantage.

It’s important to keep in mind that you won’t be eligible for other OAS benefits like the Guaranteed Income Supplement (GIS) and Allowance during the pension deferral period.

Here is a table with an estimated breakdown of OAS payments.

One important thing to note about the table above is that it doesn’t factor in any investment returns made on OAS payments. Some people wish to take their OAS pension early and invest that money rather than delaying OAS to the age of 70.

When deciding whether to defer your OAS payments, it’s important to consider different factors besides your income requirements and the potential income boost promised to you by an OAS deferment. Other factors you may want to consider include your health and any dependents.

Flow-Through Shares (FTS)

Another viable option to minimize your OAS clawback is to invest in Flow-Through Shares, or FTS. FTS can give you a tax deduction to reduce your taxable income. These types of investments are not for everyone as they can carry high risk, which can lead to significant losses, so it’s important to speak to your advisor to know if this option is suitable for you.

Other Strategies

Consider other financial planning strategies such as reallocating income to reduce or eliminate the clawback of OAS benefits. For instance, reallocating eligible pension income to enable both spouses to receive the pension income tax credit can be beneficial.

Additionally, waiting until the end of the year you turn 71 to convert your RRSP to a Registered Retirement Income Fund (RRIF) and taking only the minimum RRIF withdrawals annually can keep your net income low.

Prudent investing is also important along with understanding how different income is taxed. Not all investment income is taxed the same, so it’s important to select investments that are tax-efficient, which an advisor like a Rothenberg Wealth Management Advisor can help you with. This can also mean rearranging or rebalancing your portfolio to continue generating the income that you need but also change the type of income you receive from interest, dividends, or capital gains to return of capital, to further reduce your taxable income in a given year. Return of income capital, or ROC, is not taxable in the year it is received.

Conclusion

Old Age Security Clawback Calculator: How Much Can I Expect to Receive?

Applying strategies like income splitting, utilizing Tax-Advantaged Accounts like TFSAs and RRSPs, and opting to defer OAS payments until you turn 70 years old can be practical steps that can safeguard your income in retirement, ensuring you maintain as much of your OAS benefit as possible. Remember, every financial decision you make impacts your retirement comfort, so planning with these strategies in mind is critical.

The journey to maximizing your Old Age Security doesn’t have to be navigated alone. Whether you’re fine-tuning your current retirement plan or just starting to ponder over your future finances, professional advice can make all the difference. Contact a Rothenberg Wealth Management Advisor for retirement planning advice to explore how you can implement these strategies effectively in your overall wealth management plan.

(Image: Rothenberg Wealth Management Chief Operating Officer Raj Pandher, third from the left, pictured with the champions of the Calgary Interclub Squash Association’s Men’s Level 1 Final and the Rothenberg Cup Trophy).

Rothenberg Wealth Management is proud to have served as the Title Sponsor for the Calgary Interclub Squash Association’s (CISA) Men’s Level 1 Squash League, furthering our ongoing partnership with CISA from previous years.

Our Chief Operating Officer Raj Pandher was in attendance to represent our firm at the Men’s Level 1 Finals at the Calgary Winter Club on Saturday, April 20, 2024. Raj presented the Rothenberg Cup trophy to the members from the winning team. Congratulations to Bow Valley Athletic Club on their victory!