3-D Process

Our 3-D Process

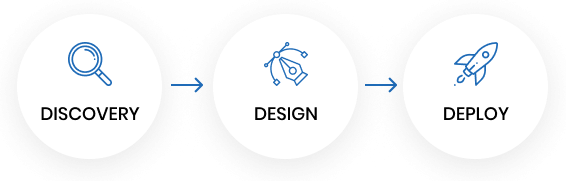

With each client, we implement our 3-D process. The 3 D’s are:

First, we embark on a discovery process to understand your specific goals and needs across family, occupation, recreation, and finances. We take the time to truly get to know you, your current life stage, as well as your values, aspirations and challenges.

Based on the information we’ve gathered up to this point, we create a custom wealth plan outlining our recommendations. This plan covers financial aspects like retirement, investment, tax, estate, insurance, and legacy planning.

Your personalized plan also includes a portfolio tailored to your risk profile, including various assets, to manage risk and boost potential returns. Your risk tolerance, investment experience, and time horizon for goals such as education, home purchase, asset purchase, business startup, recreation, and retirement are considered.

After designing your plan, we discuss its implementation. This collaborative session allows us to refine our recommendations to meet your specific goals. You then decide if you wish to partner with us on your wealth journey.

Once we establish a mutual commitment to working together, we finalize your wealth plan, initiate the client onboarding process and begin deploying the various pieces of your plan. This involves, in an initial step, coordinating with you to complete the necessary paperwork and administrative tasks related to your situation.

In regards to the deployment of you wealth plan, regular meetings are scheduled to monitor the success of your plan with your objectives. These meetings also provide an opportunity for us to note changes to your personal circumstances and goals, so we can adjust your plan if necessary.

Through continuous collaboration, we are able to ensure that your plan stays in sync with your needs, achieves your financial goals and evolves in step with changes in your life and in the markets.

Ongoing Collaboration

We don’t just stop at creating your wealth plan – our commitment to you extends further.

Your advisor will continuously evaluate your plan and investment portfolio to ensure they remain in line with changes to your personal circumstances like your financial objectives, risk profile, life changes but also with changes in the markets.

Most of our clients prefer to speak with their advisor on a regular basis. Whatever your preference, you may contact or meet with your Rothenberg advisor at any point in time during working hours at our office, by phone or over video call and as many times as you like to review your financial plan, receive updates or check-in regarding any questions you may have.

As a rule of thumb, we recommend meeting with your advisor at least once per year to review your plan and ensure its alignment with your needs and goals.